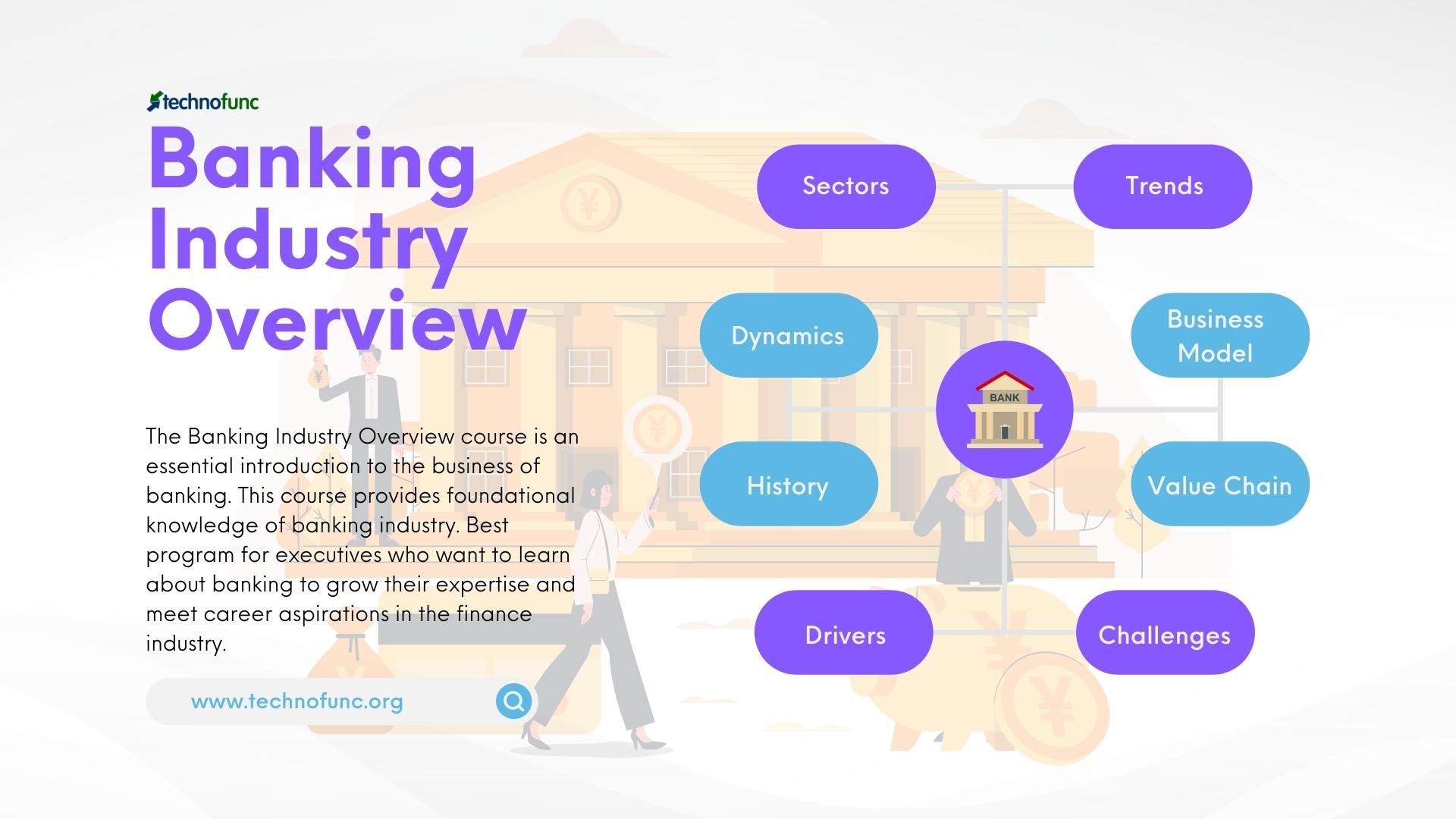

TechnoFunc brings to you the foundational course on banking industry. This course will provide you with the overview, business model, value chain, competitive landscape, and latest trends in the banking industry. Take this course to quickly enhance your business acumen in the banking domain and impress your stakeholders in your next meeting!

Banking Industry Domain Knowledge - Foundation Course provide a comprehensive learning experience to allow students to gain an understanding of the banking industry and how it operates. This courses cover a variety of banking concepts, and also include lesson transcripts, video lessons, practice exams, and certificates to those who complete and pass the final assessment. This Introductory course covers the fundamental knowledge about the banking industry. We will discuss the various types of financial institutions and how they differ in the types or products and services provided to their own customer groups. We can look at a bank’s balance sheet and income statement and understand how a bank generates return.

A career in the banking sector exposes individuals to a wide range of opportunities, and qualified banking professionals can offer services such as loans and investments, risk management, stock analysis, auditing, and corporate acquisitions. Finally, in this course we will also explore the common career paths in different areas of banking.

This comprehensive course introduces you to the basics of the banking industry using non-technical language, the concepts related to banking are explored. The course covers the fundamental principles and technologies used by banking industry professionals. Upon completion you will emerge with a general understanding of the banking industry, its components, processes and technologies, and be able to relate this knowledge to the operations of banking companies. This course will transform you in a relatively short time to help you see all the elements of the banking business.

The key takeaway would be understanding how the banking business works; the core issues and challenges involved; the key terms and terminologies associated and an appreciation of the banking sector.

You will receive all the resources required to complete the course from us. There are no submission deadlines, and anyone from anywhere in the world can enroll in this course at any time. Our professional courses give you the perfect opportunity to expand your knowledge, learn new skills, and explore other careers. You will receive a certificate of completion once your course has been satisfactorily completed and you have passed the final exam. Each of these certificates may be valuable in enhancing future job applications or advancing your career with your current employer.

Learning Outcomes - What you will learn!

With the introduction of new business models and technology advancements, the banking sector is changing and becoming highly complex. People who work in this sector in various capacities need to have a comprehensive understanding of the banking industry while also being able to comprehend the business model, dynamics, and other specifics. Even those who have worked in banking for years struggle to grasp the big picture, but this course fills that gap. In a short amount of time, this course will change you and assist you in understanding every aspect of the banking industry.

After studying this unit, the learner should be able to understand:

This course will help you drastically improve your knowledge and skills by helping you understand key concepts, terminology, issues, and challenges associated with the banking industry. This course will also focus on how the industry is deploying technology to meet some of those challenges. In this course, we will discuss the evolution of the industry, its business model, main sectors, value, and supply chain, and the competitive environment in which the industry operates. Students will also learn about the current trends and technological advances happening in the industry. The key takeaway would be understanding how the banking business works; the core issues and challenges involved; the key terms and terminologies associated and an appreciation of the banking sector.

This course is an intensive programme, covering several faucets of the banking sector, including:

- Understand the different bank types and their activities

- How money is created

- Identify the products and services offered by banks to consumers and retail clients

- Recognize the products and services offered by banks to businesses and corporations of all sizes

- Structures of banks and how they make money from each product

- Gain an overview of the current trends and opportunities in the global retail banking space

- Identify how banks function in preparation for your own career objectives

- What is the role of Central Banks and their influence

- Overview of the payment process

- Improve you skills to work in the banking industry and learn the industry jargon

- Gain certification